South Africa offers diverse short-term insurance options for individuals and businesses, catering to various needs and budgets. Types include vehicle, household, and personal liability coverage, with cheap plans focusing on flexibility and affordability. Leading companies provide competitive rates, ensuring financial security during unexpected events. Individuals can choose from comprehensive packages or standalone policies, balancing cost and coverage. Understanding specific needs, comparing providers, and evaluating claims processes help secure adequate protection at reasonable prices, especially for temporary situations like waiting for long-term insurance or occasional vehicle use.

“In South Africa, understanding your insurance options is key to financial peace of mind. This comprehensive guide delves into the diverse world of short-term insurance, a vital safety net for individuals and vehicles. We explore various types of plans available, focusing on cost-effective solutions for cars, as well as navigating claims processes. From comprehending different coverage types to selecting the right insurer, this article equips readers with knowledge to make informed decisions regarding their short-term insurance needs, ensuring they’re protected without breaking the bank.”

- Understanding Short-Term Insurance: A Comprehensive Overview

- Types of Short-Term Insurance Plans Available in South Africa

- Cheapest Short-Term Insurance Options for Cars and Vehicles

- How to Choose the Right Short-Term Insurance Company

- Benefits and Considerations of Short-Term Coverage

- Navigating Claims and What to Expect

Understanding Short-Term Insurance: A Comprehensive Overview

Short-term insurance is a crucial aspect of financial planning in South Africa, offering various types of coverage to cater to diverse needs. It provides temporary protection against specific risks, allowing individuals and businesses to safeguard their assets and manage potential financial losses. Understanding these different short-term insurance plans is essential for making informed decisions.

In the vibrant market of South African insurance, there are several options available, including vehicle, household, and personal liability coverage. For car owners, cheap short-term insurance can provide peace of mind, especially for short-term needs like temporary car rentals or while awaiting a new policy. The cheapest short-term insurance plans often come with flexible terms, allowing policyholders to choose the level of cover and duration that suits their requirements. Leading short-term insurance companies offer competitive rates and a range of plans, ensuring individuals can find suitable coverage at affordable prices. These plans typically cover unexpected events such as accidents, theft, or natural disasters, providing financial security during uncertain times.

Types of Short-Term Insurance Plans Available in South Africa

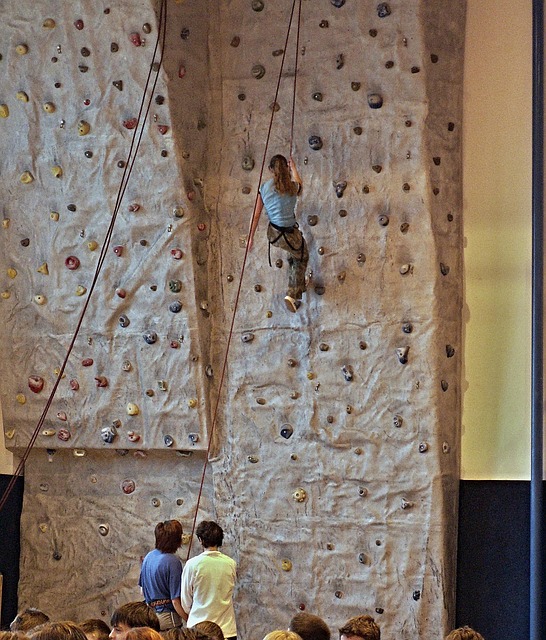

In South Africa, individuals have a variety of short-term insurance plans to choose from, tailored to suit different needs and budgets. Among the most popular types are those designed for vehicles, offering coverage for cars, motorbikes, and even recreational vehicles at competitive rates. These cheap short term insurance car options are especially appealing to young drivers or those with limited driving experience looking for short term insurance plans.

Beyond vehicle-specific policies, there are comprehensive short term insurance packages that cover a range of unforeseen events, from medical emergencies to property damage. These types of short term insurance include travel insurance, which is ideal for vacationers, and liability insurance, protecting against claims related to personal injuries or property damage caused by the insured individual. The cheapest short-term insurance often comes in the form of standalone policies that offer specific protections without unnecessary add-ons, making them attractive for those seeking cost-effective solutions without compromising on necessary coverage.

Cheapest Short-Term Insurance Options for Cars and Vehicles

When it comes to insuring your vehicle for the short term, South Africa offers a variety of options to suit different budgets and needs. The cheapest Short-Term Insurance for cars often appeals to those looking for temporary cover while their long-term policy is in process or for occasional users. This type of insurance typically covers against third party liability, which is mandated by law, but also includes optional add-ons such as collision and comprehensive coverage for a nominal fee.

Popular short-term insurance companies provide flexible plans that can be tailored to your specific requirements. These plans are ideal for students, temporary residents, or anyone needing insurance for a few months. By comparing different Short Term Insurance plans from various companies, you can find the most affordable option that still provides adequate protection for your vehicle.

How to Choose the Right Short-Term Insurance Company

When choosing a short-term insurance company, the first step is to understand your needs. Different types of short-term insurance plans cater to various scenarios – from travel and medical coverage to specific events like weddings or holidays. Researching and comparing short term insurance companies and their offerings will help you find the most suitable plan at an affordable price. Look for companies that provide transparent pricing, a wide range of options, and excellent customer service.

Next, assess your budget. While it’s tempting to opt for the cheapest short-term insurance, remember that the lowest price doesn’t always guarantee the best value. Consider what is covered, exclusions, and the level of protection you require. Balancing cost and comprehensive coverage will ensure you’re adequately insured without overspending on unnecessary features. For instance, if you’re looking for cheap short term insurance car coverage, understand the specific risks associated with driving and choose a plan that covers these appropriately.

Benefits and Considerations of Short-Term Coverage

Short-term insurance offers a range of benefits for South African individuals and businesses, especially when compared to long-term policies that often come with higher premiums. One of the primary advantages is its affordability; cheap short term insurance car options are readily available, making it an attractive choice for those on a budget. This type of coverage can provide essential financial protection for a specific period, whether it’s for a new business venture, temporary relocation, or unexpected life events.

When considering short-term insurance plans, it’s crucial to evaluate different types and providers to find the best fit. South Africa has numerous reputable short term insurance companies offering various options like comprehensive vehicle coverage, personal liability, and business protection. While the cheapest short-term insurance may be tempting, policyholders should assess their needs and compare benefits to ensure they receive adequate protection. Different plans cater to specific requirements, so understanding the scope of coverage is essential before making a decision.

Navigating Claims and What to Expect

Navigating claims with short-term insurance can vary depending on the company and the specific plan you’ve chosen. However, understanding the process beforehand can help alleviate any anxiety. Most short-term insurance companies have straightforward claims procedures, often involving a simple online or phone claim submission. Once submitted, an adjuster will review your claim and assess the validity and scope of the damages or losses.

What to expect during this process includes clear communication from your insurer about the status of your claim, timely updates on the evaluation, and potentially, requests for additional information or documentation. For instance, if you’ve taken out cheap short-term insurance for your car, you may need to provide photos or repair estimates. The cheapest short-term insurance isn’t always the best option if claims handling is poor. Thus, when comparing short-term insurance plans, pay close attention to not just price but also the reputation and customer service of the insurance company. This ensures that when you do need to make a claim, it’s handled efficiently, leaving you less stressed and more prepared.